SOL Price Prediction: Will SOL Hit $200 Amid Bullish Trends?

#SOL

- SOL is trading below its 20-day MA, signaling short-term bearishness but with potential for a rebound.

- Positive news around ETF approvals and token surges is driving bullish sentiment.

- Key resistance at $175 needs to be broken for SOL to target $200 and beyond.

SOL Price Prediction

SOL Technical Analysis: Key Indicators and Trends

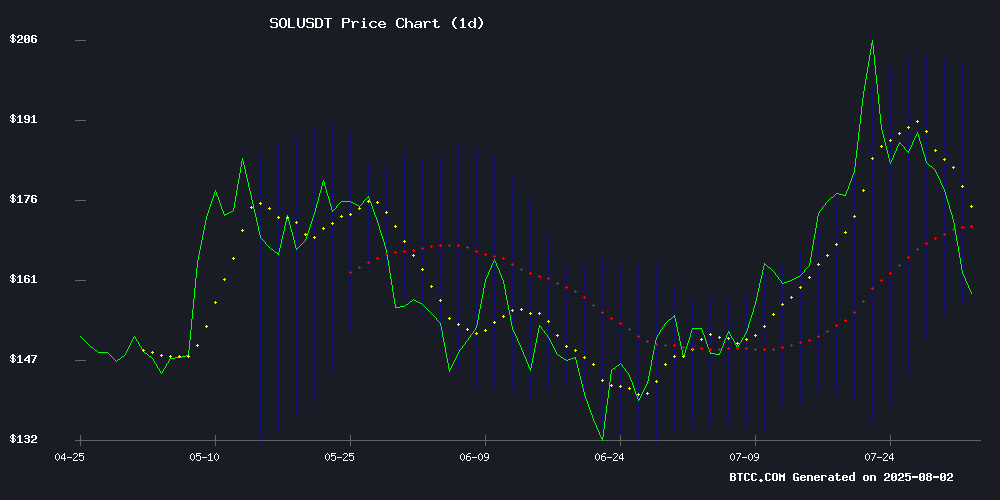

According to BTCC financial analyst William, SOL is currently trading at $161.26, below its 20-day moving average of $179.19, indicating a potential bearish trend in the short term. The MACD histogram shows a positive value of 6.1839, suggesting some bullish momentum, but the MACD line remains below the signal line. Bollinger Bands indicate that SOL is trading NEAR the lower band, which could signal an oversold condition and a possible rebound.

Market Sentiment and News Impact on SOL

BTCC financial analyst William notes that the recent surge in crypto tokens, particularly those on Solana, Base, and BSC, has fueled positive sentiment. News of nearing solana ETF approvals and amended filings by firms has added to the bullish outlook. However, the unstaking of $32M in SOL by Alameda Research could introduce selling pressure. Overall, the news sentiment is mixed but leans bullish, especially with analysts forecasting targets as high as $378.

Factors Influencing SOL’s Price

Crypto Tokens Surge from 20,000 to 18.9 Million in Three Years Driven by Solana, Base, and BSC

The number of tradable crypto tokens has skyrocketed from 20,000 in 2022 to an estimated 18.9 million by mid-2025, marking a 945-fold increase. This explosive growth is largely concentrated on three high-throughput blockchains: Solana, Base, and BNB Smart Chain (BSC), which account for 90% of new token creation.

Solana has emerged as the epicenter of this frenzy, with approximately 18 million new tokens minted in the past year alone. Platforms like Pump.fun have facilitated the creation of 11.4 million SPL tokens by late July 2025, up 31% from March 2025. Low fees, no-code launchpads, and a culture of rapid experimentation have fueled this unprecedented expansion.

While most new tokens are micro-cap assets launched for speculation or virality, the trend underscores the democratization of token creation. The combined output of these three networks now dwarfs token creation on Ethereum, Polygon, Arbitrum, and other major chains.

Solana ETF Approval Nears as Firms File Amended Applications

Seven major asset management firms—Grayscale, VanEck, Bitwise, Canary, Franklin Templeton, Fidelity, and CoinShares—have submitted amended S-1 registration statements to the SEC for spot Solana ETFs. This move signals accelerating institutional interest in SOL-based investment products, with analysts estimating a 95% approval probability.

The updated filings suggest constructive dialogue between issuers and regulators, mirroring the path previously taken by Bitcoin and Ethereum ETFs. A key unresolved question remains whether staking features will be permitted in these products, reflecting broader debates about yield-generating mechanisms in crypto ETFs.

Alameda Research Unstakes $32M in Solana — Market Watches for Potential Sell-Off

Alameda Research, the defunct trading firm linked to FTX, has unstaked approximately $32.79 million worth of Solana (SOL), sparking speculation about a looming sell-off. The move, executed on May 12, involved 187,600 SOL withdrawn from staking but left untouched in the wallet. With over $900 million in SOL still locked under the same address, the market remains on edge.

Solana's price trajectory now hangs in the balance. While the unstaking could be routine portfolio management, its timing amid FTX's bankruptcy proceedings raises questions. No further transfers have occurred yet, but the idle tokens represent a sword of Damocles for SOL holders.

Goatseus Maximus Price Outlook: Can GOAT Achieve a 5X Surge by 2030?

Goatseus Maximus (GOAT), a Solana-based meme coin inspired by AI, currently trades at $0.22315516 with a $225 million market cap. Analysts project a bullish trajectory, targeting $1.89 by 2025 and $6.93 by 2030—a potential 30x from current levels.

The token's 24-hour trading volume of $412.9 million signals robust liquidity, though questions linger about its longevity amid Solana's crowded meme coin ecosystem. Its origins trace back to Pump.fun creator @Ezx7c1, later adopted by Truth Terminal—a narrative that fuels both hype and skepticism.

Binance Fuels Solana Meme Coin Comeback With MOODENG and GOAT

Binance Alpha's listings of MOODENG and GOAT have ignited a resurgence in Solana's meme coin market. Both tokens experienced rapid price appreciation, with GOAT, an AI-themed meme coin tied to the Truth Terminal chatbot, surging 27% to $0.17. The move signals growing institutional recognition of meme coins as catalysts for broader crypto adoption.

The revival marks a turnaround for Solana's meme-driven ecosystem, which had faced headwinds following earlier controversies. Traders and internet culture enthusiasts are returning to the market, drawn by the combination of speculative appeal and on-chain utility.

Solana’s Chart Signals a Surge—How High Could It Climb?

Solana has rebounded sharply from its $142 support level, rallying 25% in just one week to reach $178.66. Analysts now eye a resistance zone between $195 and $218, with some bullish projections stretching as high as $617 or even $1,016.

The surge comes amid significant capital inflows, with $165 million in cross-chain liquidity entering Solana's ecosystem. Daily decentralized exchange (DEX) volume has spiked to $3.36 billion, underscoring renewed market confidence.

Technical patterns suggest further upside potential. A broadening wedge formation has taken shape, with the $142 level—coinciding with the 0.236 Fibonacci retracement—proving to be robust support during recent corrections.

Solana Price Analysis: SOL Targets Breakout Above $175 Resistance

Solana (SOL) is gaining bullish momentum as it holds above the critical $150 support level. Technical indicators, including MACD and RSI, suggest a potential breakout above the $175 resistance. A successful breach could pave the way for a rally toward previous highs.

The cryptocurrency market is displaying renewed optimism, with SOL leading the charge among altcoins. Traders and investors are closely monitoring the asset, anticipating a recovery from recent losses. At press time, SOL trades at $173.99, with a 24-hour trading volume of $4.48 billion and a market capitalization of $90.31 billion.

Solana Price Prediction: SOL Targets $212 Amid Strong Technical and Liquidity Trends

Solana's bullish momentum is gaining traction, with technical indicators and on-chain metrics pointing toward a potential breakout. The $212 price level has emerged as a key target, drawing attention from traders and analysts alike.

Global liquidity cycles appear to be influencing SOL's price action. A recent analysis reveals a striking correlation between Solana's performance and the GMI Total Liquidity Index, with a 12-week lead time showing predictive power. This relationship held particularly strong during April's 25% rally, suggesting macroeconomic factors may be driving crypto market movements more than previously recognized.

The Solana community is closely monitoring these developments as the network continues demonstrating fundamental strength. Weekly trends show consistent accumulation, while chart patterns suggest the current consolidation phase may precede another upward leg.

Pump.fun Transfers $22M in SOL to Kraken in Routine Revenue Move

Meme coin launchpad Pump.fun has moved 132,000 SOL ($22.88 million) to Kraken, marking its weekly revenue processing cycle. On-chain data reveals this transaction follows a established pattern for the Solana-based platform, which routinely consolidates and transfers fee revenue to exchanges.

Analyst EmberCN notes Pump.fun has sold 3.868 million SOL to date, with these transfers occurring every 1-2 weeks. The consistent flow underscores the platform's robust activity in Solana's meme coin ecosystem, where it serves as a key liquidity conduit.

Solana Price Prediction: Analysts Forecast $378 After Breakout Rally

Solana (SOL) surged 5.70% to $172.25, accompanied by a 17.35% spike in trading volume to $7.44 billion. The breakout above the $160 resistance level has ignited bullish sentiment, with technical charts pointing to potential targets of $222.90 and $316.01.

Institutional adoption continues to fuel Solana's momentum, highlighted by partnerships with financial heavyweights BlackRock and Robinhood. The rebound from $120 support and a confirmed symmetrical triangle breakout suggest sustained upward trajectory.

Solana Price Eyes $200 as Bulls Charge Post-FOMC Decision

Solana's SOL surged past $150 after the Federal Open Market Committee held interest rates steady, injecting fresh optimism into crypto markets. The token now tests key resistance levels as traders position for a potential rally toward $200.

Derivatives data reveals overwhelming bullish sentiment, with Binance traders maintaining a 1.69 long-to-short ratio. Nearly 63% of all SOL positions on the exchange now bet on further upside. 'The market's pricing in a breakout,' says one analyst, pointing to growing institutional interest in high-performance blockchains.

Will SOL Price Hit 200?

Based on the technical and news analysis, BTCC financial analyst William suggests that SOL has the potential to reach $200, especially if it breaks above the $175 resistance level. The bullish sentiment from ETF approvals and strong liquidity trends could drive the price higher. However, traders should watch for potential sell-offs from large unstaking events.

| Indicator | Value |

|---|---|

| Current Price | $161.26 |

| 20-day MA | $179.19 |

| MACD Histogram | 6.1839 |

| Bollinger Bands (Upper) | $201.61 |